Table of Contents

- Australia Income Tax Rate 2025 - Shae Yasmin

- Believe it or not...1 in 3 Australian households has net wealth of more ...

- Australian Tax Brackets in 2025 - Tax Basics for Beginners - YouTube

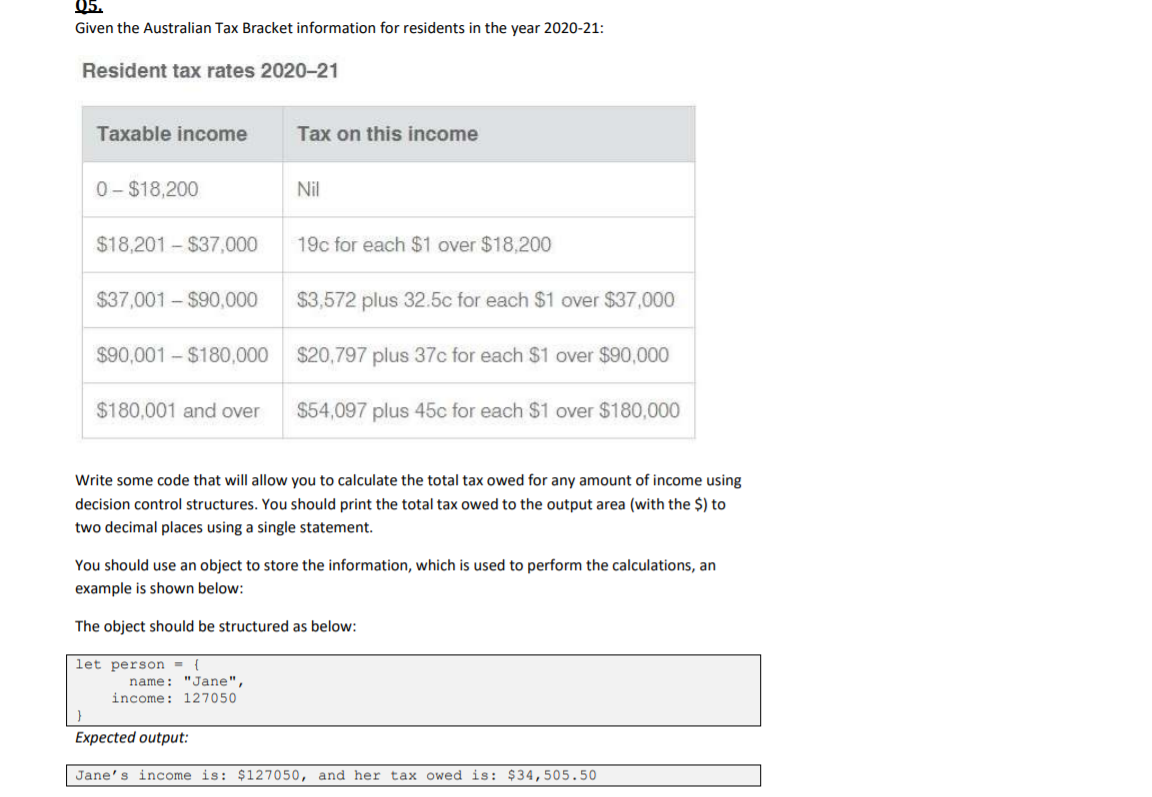

- Solved 05. Given the Australian Tax Bracket information for | Chegg.com

- New Tax Brackets 2025 Australia Pdf - Debee Nataline

- Tax Brackets in Australia for 2022

- Australian income tax brackets and rates (2025-25 and previous years)

- Australia world leader in income tax surge, OECD data reveals | news ...

- Australia's Average Tax Rate Increase Leads OECD Countries Due to ...

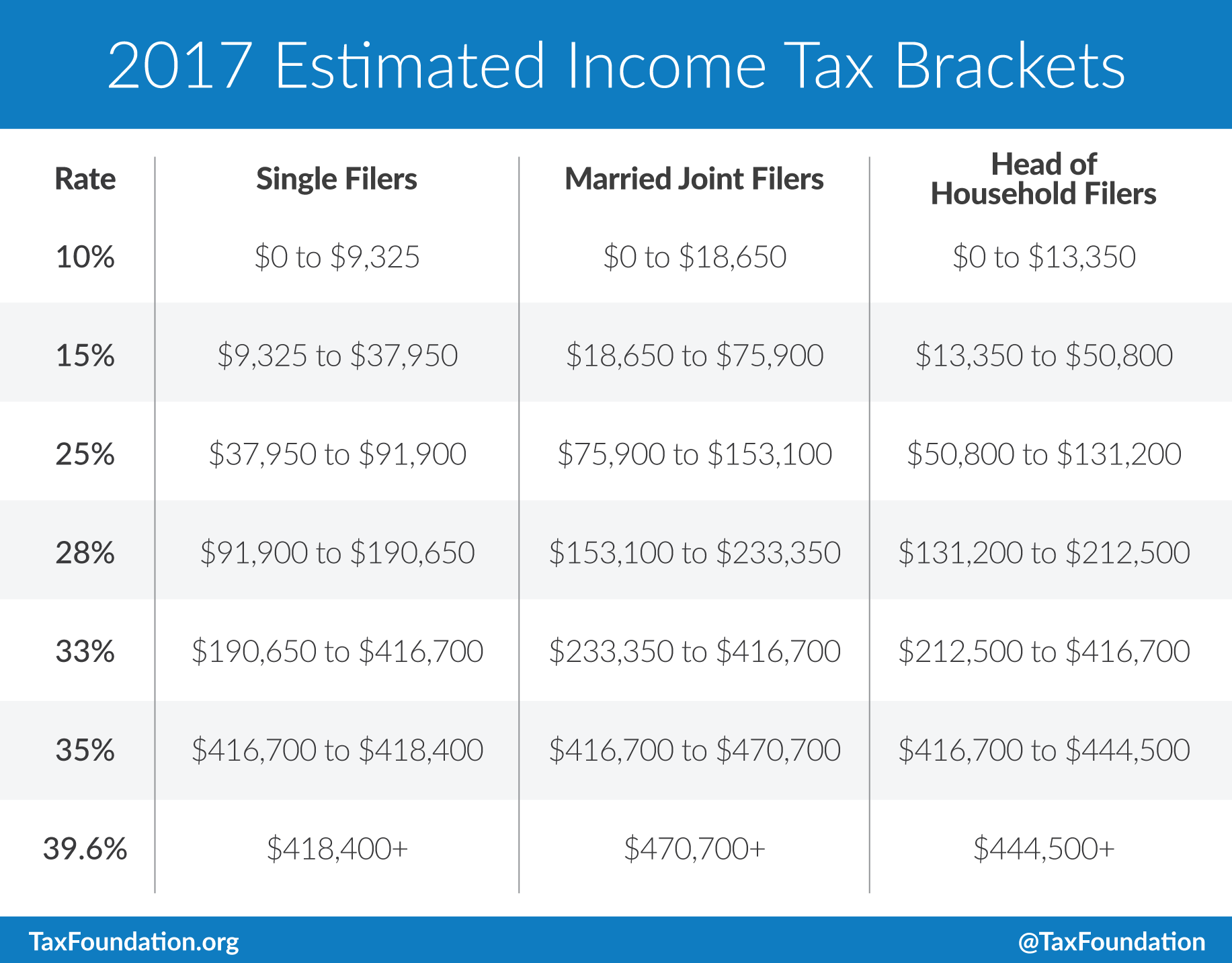

- Income Tax Tables 2017 Australia | Cabinets Matttroy

What are Tax Brackets?

- 10%: $0 to $9,875 (single) or $0 to $19,750 (joint)

- 12%: $9,876 to $40,125 (single) or $19,751 to $80,250 (joint)

- 22%: $40,126 to $80,250 (single) or $80,251 to $171,050 (joint)

- 24%: $80,251 to $164,700 (single) or $171,051 to $326,600 (joint)

- 32%: $164,701 to $214,700 (single) or $326,601 to $414,700 (joint)

- 35%: $214,701 to $518,400 (single) or $414,701 to $622,050 (joint)

- 37%: $518,401 or more (single) or $622,051 or more (joint)

How Do Tax Brackets Apply?

Let's say you're single and your taxable income is $50,000. You'll pay 10% on the first $9,875, 12% on the amount between $9,876 and $40,125, and 22% on the amount between $40,126 and $50,000. You won't pay 22% on the entire $50,000, just on the amount above $40,125.

Federal Income Tax Rates

The federal income tax rates are as follows:The federal income tax rates range from 10% to 37%. The rates are adjusted annually for inflation, and the IRS publishes the new tax tables and rates each year. The federal income tax rates apply to taxable income, which is your gross income minus deductions and exemptions.

Understanding tax brackets and how they apply is essential for managing your finances and minimizing your tax liability. By knowing which tax bracket you're in, you can make informed decisions about your income and deductions. Remember, the federal income tax system is progressive, and higher income earners are taxed at a higher rate. If you have any questions or concerns about tax brackets or federal income tax rates, consult with a tax professional or financial advisor.It's also important to note that tax laws and regulations are subject to change, so it's essential to stay up-to-date on any changes that may affect your tax situation. By staying informed and planning ahead, you can navigate the complex world of tax brackets and federal income tax rates with confidence.